The Best Travel Credit Cards for Every Type of Traveler 2025: A Comprehensive Guide

Introduction: Are you a common flyer, a road trip fanatic, or a person who simply loves to discover new locations? Choosing the right credit card may be a game-changer for your travel experiences in 2025.The best credit cards aren’t just about earning points.They’re approximately unlocking specific tour perks, saving cash on flights and hotels, or […]

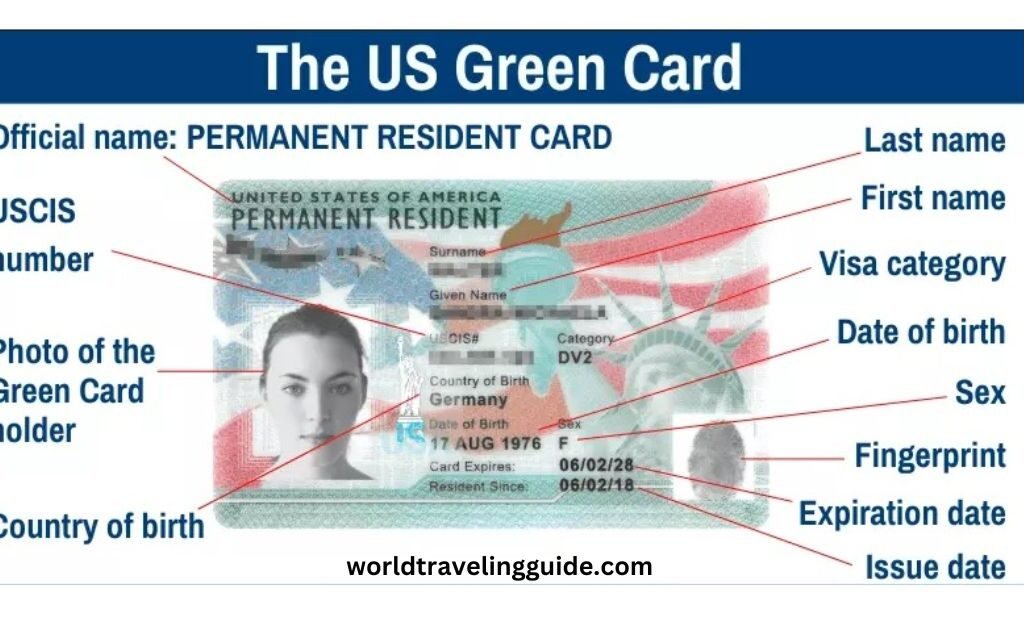

How Much Is Travel Document Fee For Green Card Holders

In this article, we will discuss, how much is travel document fee for Green Card Holders and the cost of travel documents for green card holders, the different types of travel documents that can be obtained, the application process, and some essential tips for making traveling easy. Green card holders, known as lawful permanent residents […]

Which Item Is a Benefit of Using the Travel Card?

Introduction: A travel card is essential when moving across cities. It is similar to a debit or credit card but more appropriate for foreign trips. They allow you to load different currencies on it without wasting time finding a currency exchange. A travel card is particularly beneficial due to the protection it provides. Instead of […]